Context

Suppose you are the CIO of an investment company experiencing a surge in inquiries from investors who want their portfolios to reflect their personal ethics and social values. As this trend grows, your company’s current platform is struggling to keep up with the demand for a more personalised, flexible investment experience. Retail investors are now seeking alternatives that offer the tools and information they need to assess the ethical practices of potential investments and make informed decisions on who to include or exclude from their portfolios.

The challenge is particularly acute for retail investors who often lack the expertise or access to reliable resources to evaluate ethical investments. Many are sceptical of existing resources, such as ESG scores, which they view as easily manipulated by corporations, leading to further confusion and frustration.

Faced with these challenges, I, along with my team, set out to design a solution that would empower retail investors to align their portfolios with their values while ensuring the platform remained competitive. In the following case study, I will explain how we tackled these pain points, developed a flexible and user-friendly design, and ultimately delivered a proposal that not only enhances the investor experience but also adds business value.

This is a brief presentation of the case study and a complete version is available upon request.

Project Objectives

With this project, the objective was to make sure the current and future retail investors are able to customise their portfolios to align with their personal values. The following are the accomplishments intended for the user:

An intuitive system that would address their preferences.

Availability of reliable resources to make informed decisions on potential investments.

Access to diverse investment options.

Business Objectives

Despite focusing on the user/investor interests, business objectives had to be considered including performance metrics. The below are the business goals for this project and how KPIs would be measured.

Expand Market Share

Retain existing retail investors while attracting new ones who are interested in values-based investing.

KPIs

Increase the number of new accounts by 5% in the first 3 months after update launch.

Enhance Product Offering

Diversify investment options to include more ethical and values-based choices.

KPIs

Add at least five new ethical investment products to the platform within three months.

Improve User Satisfaction

Address retail investor preferences and pain points to increase overall user satisfaction

KPIs

Achieve a customer satisfaction score of 80% or higher in post-launch surveys.

Increase Engagement

Observe emerging technologies and offer features that resonate with retail investors to encourage frequently platform usage.

KPIs

Achieve a customer satisfaction score of 80% or higher in post-launch surveys.

The project launched with academic research on ethical investing. This helped the team understand its origins and impact towards retail investor preferences. We then formulated hypotheses to test and recruited target participants through online screening. I interviewed and had focus group discussions with participants and it provided rich data (participant quotes) that I summarised with AI tools like Otter.ai. These summaries were the foundation for our affinity map, built with DoveTail and Figma.

Research Questions

Why did you choose to make your investment portfolio align with your values?

Goal: To understand if increased social awareness is a driving motivator for investors to align their portfolios with their values.

What pushed for this change?

Goal: To identify the specific triggers or influences (e.g., social movements, campaigns) that lead investors to shift towards ethical investing and explore their impact.

Are the reasons internal(personal) or external?

Goal: To investigate whether the shift towards ethical investing is driven by personal values or external influences (i.e: regulatory requirements, reporting standards, peer groups, etc.) and whether it is influencing investors’ decisions to adopt values-based investing, compared to personal convictions.

When it comes to investing based on values, does profit matter?

Goal: To assess the importance of financial performance for investors who prioritise ethical values. This question evaluates whether these investors are willing to sacrifice returns for values-based investments or if financial performance remains a critical consideration.

Research Methodology

Focus Groups

40+ screened participants. These were a diverse pool of individuals with different backgrounds and investments were brought in for this discussion.

Process

Virtual structured discussions

Virtual screen recording with desktop devices i.e. laptop.

Utilising online video conferencing tools such as Zoom.

A 30-minute session each day for 8 days, with 5 to 6 participants per session.

40+ participants

Sampled from investment forums and platforms.

Online recruitment via professional network.

Hybrid Coding

A mixed-methods approach, using both inductive and deductive coding on the gathered rich-data. The data was then organised and analysed using Dovetail.

Method

From the focus group transcripts, I conducted inductive coding for in-depth understanding by using the rich-data to make segments, categories, and generate relevant codes.

Next was deductive coding where I used the previously created codes to assign on quotes, comments and overall transcript of each focus group discussions. I then conducted a thematic analysis to identify, analyse, and report patterns within the qualitative data.

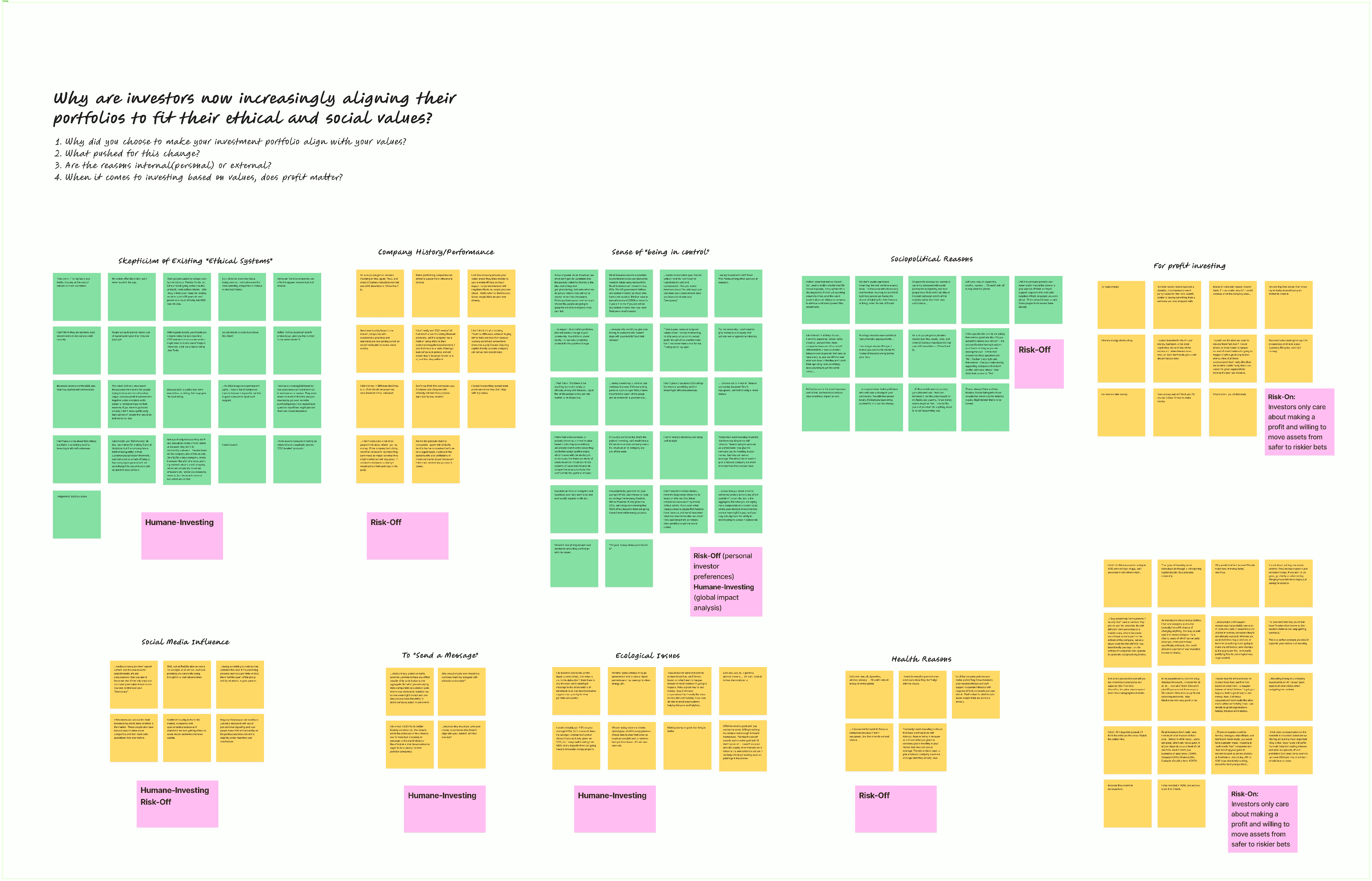

Affinity Mapping

After the coding part of the thematic analysis, next was grouping all findings into categories and use an affinity map to organise the data.

Process

Placed all the codes and phrases from the inductive/deductive coding on figjam and began looking for similarities. Codes and phrases that had similar patterns were grouped together and ranked what category had the most pattern occurrence. These were then classified as the emerging themes for the research.

The top three emerging themes for this problem were:

1. Skepticism of Existing “Ethical Systems”.

2. Sense of “being in control”.

3. Sociopolitical Reasons.

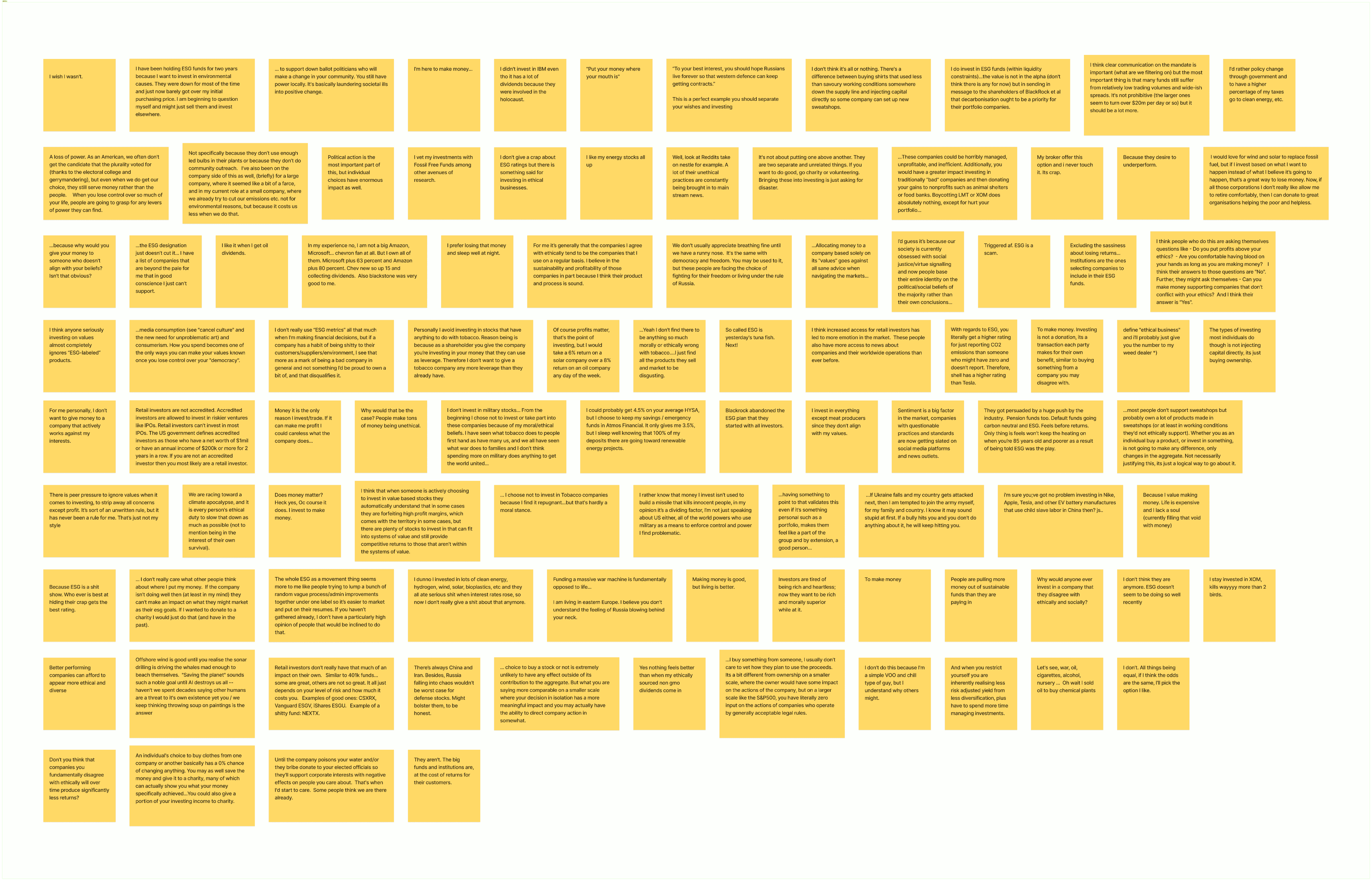

Fig 01

The original notes on comments made by participants in the interviews and focus groups.

Fig 02

Research notes and rich-data grouped into thematic categories with affinity mapping.

Key Research Findings

Findings are solutions that can be implemented immediately, without possible future impact. We discovered that while there is a growing interest in ethical investing, it is accompanied by significant skepticism and a demand for greater transparency. Investors are divided between prioritising financial returns or favouring ethical considerations. Many are seeking a balance between the two.

The pain points highlight the need for more reliable and authentic *ESG information, as well as a broader range of investment options that align with diverse ethical beliefs. The major key findings from this research are discussed below:

Skepticism Towards ESG

User Needs: Investors seek ESG initiatives that drive authentic change, pushing companies to move beyond empty promises.

Pain Points: It’s difficult to measure the real impact of ESG. Some investors view it as a way for companies to garner positive PR without substantive change.

Behaviours: This skepticism leads some investors to disregard ESG labels and instead focus on their research or traditional investment metrics.

Control & Accessible Ethical Options

User Needs: Desire for readily available ethical investments and complete control of their investment methods. They prefer convenience without any bureaucratic red-tapes.

Pain Points: The market offers few truly ethical options, and those available are often indistinguishable from conventional investments.

Behaviours: Investors increasingly seek convenience and control, often turning to other resources to screen their investments. They value the ability to make choices that reflect their personal values, even with limited market impact.

Transparency, Authenticity & Support

User Needs: Transparency and authenticity in *ESG reporting with clear and reliable information on company performance and ethical metrics. Support from portfolio managers is also expected in such cases.

Pain Points: Investors widely distrust ESG ratings, concerned that companies may manipulate data to appear more ethical.

Behaviours: Some investors are skeptical of ESG-labeled products and avoid them altogether, while others are cautious and seek additional information and support to verify a company's ethical practices.

During the design/development phase of the project, I used the reframed statement to help us ask the right questions from the users’ perspective. To guide our ideation efforts, I applied the “How-Might-We” framework around the key user concerns: How might we cultivate trust towards ethical systems? How might we make the user feel heard, confident and in control of their investment? How might we provide inexperienced investors with 24/7 support resources?

Persona + Scenario

To ensure the product aligns with user needs, I crafted user stories based on detailed personas. These personas were created using insights gathered from focus group discussions and interviews. This teaser will only present John as the primary persona and explore his user scenario.

John is an investor who has developed a keen interest in the healthcare sector right after his grandfather passed from a complicated heart condition.

From his experience in working with medical professionals to care for his late grandfather, he believes that the healthcare industry is a significant pillar of altruism in society. With this knowledge, he decides to customise his investment portfolio to reflect this new alignment.

John is particularly interested in companies that are at the forefront of medical innovation, pharmaceuticals, and healthcare services. He decides to utilise Morningstar’s investment platform to simply, but effectively tailor his portfolio towards ethical healthcare-related investments.

Motivation

His personal experience with his grandfather’s healthcare journey drives his focus on supporting medical innovation.

Make a positive impact through investments that contribute to advancements in healthcare.

Ensure his portfolio supports ethical companies that align with his principles.

Pain Points

Doesn’t have time to manually customise his portfolio to align with his values.

In search of a reliable tool that saves time and recommends ethical-driven investments.

There isn’t additional assurance that his investments genuinely reflect his values.

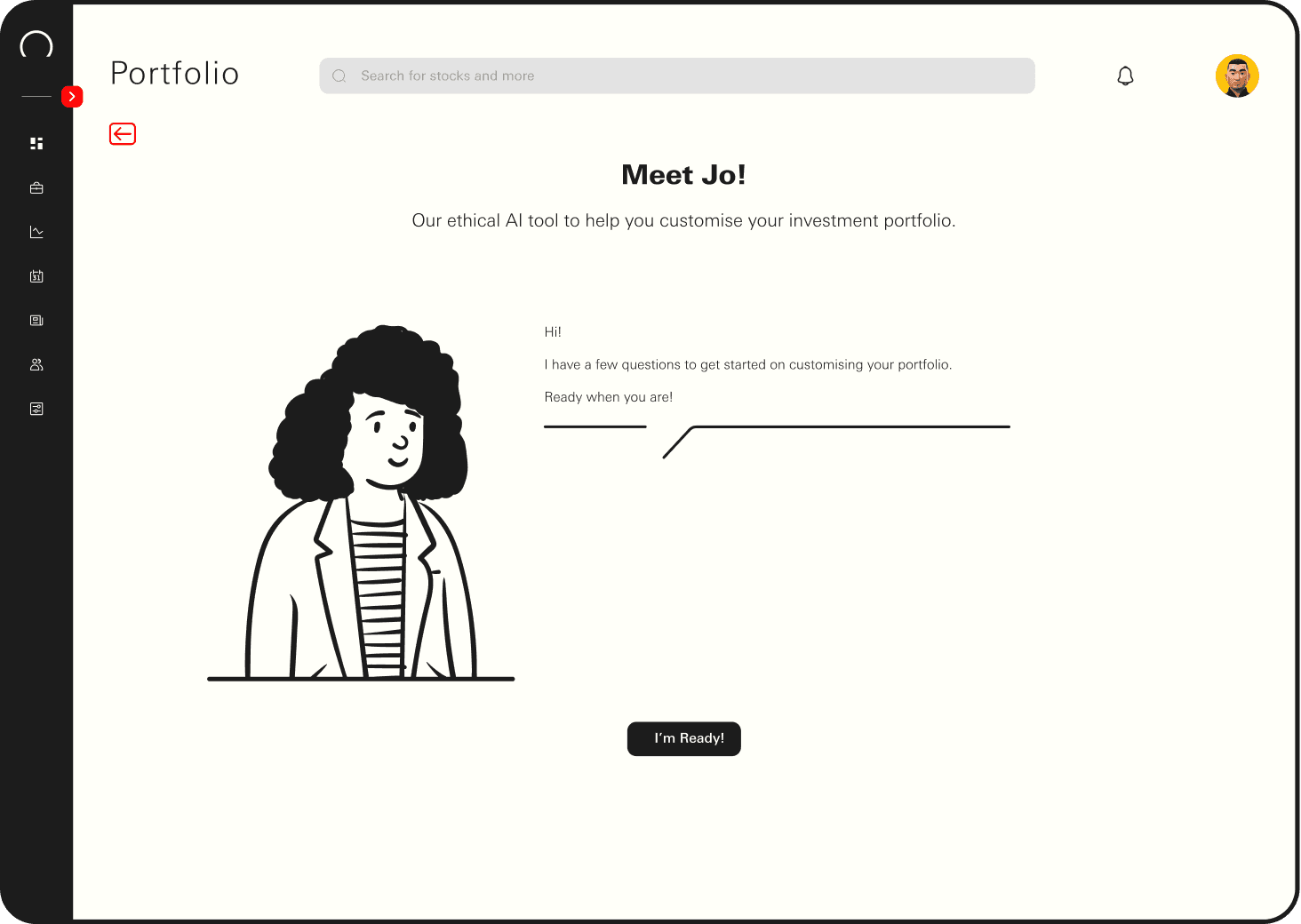

Let’s do this!

First thing Monday morning...

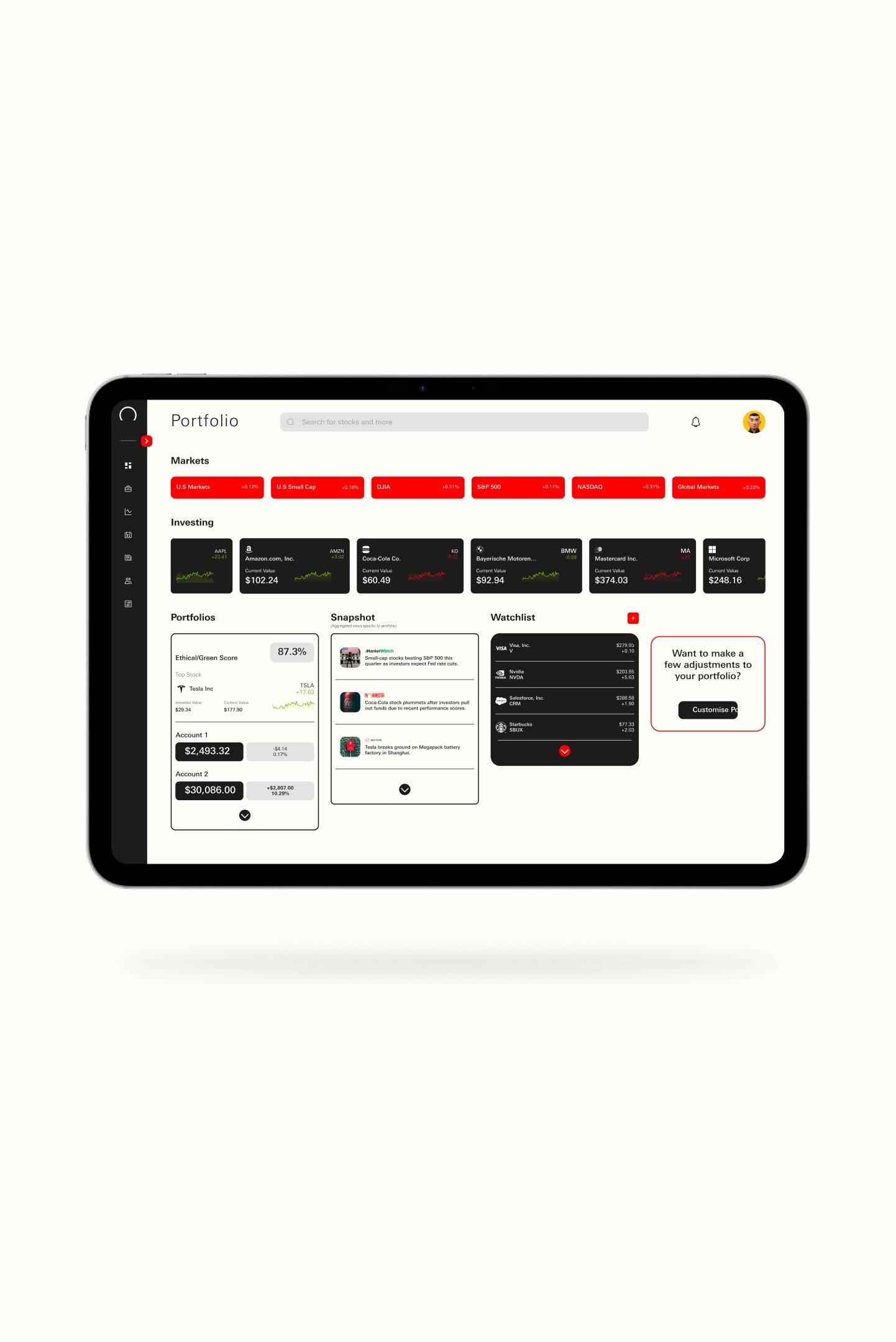

Over the weekend, John decides that he’s going to realign his investments to fit his ethical values. Come Monday morning, he logs into the platform and navigates to the “Portfolio” screen to start customising his investments.

Umm...where do I even start??

I’m still new to this. I need some help...

John wants to be efficient with his investing and doesn’t want to waste time navigating the intricacies. In an effort to address his need for efficiency and effectiveness, he selects “Customise with AI” option.

Whew!...heheh. That’s more like it!

Ok, we’re getting somewhere!

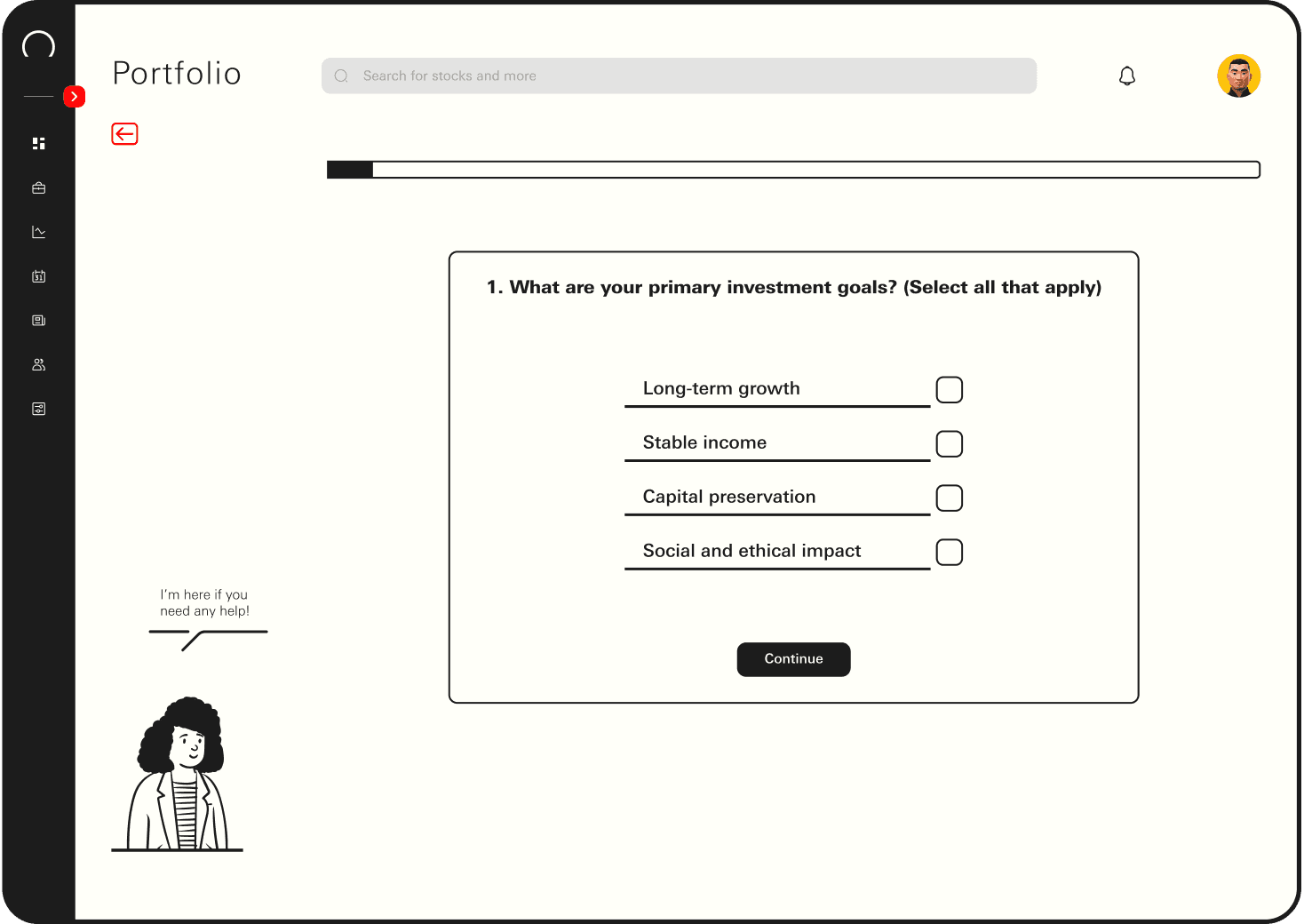

The AI tool prompts John to complete a quiz about his investment goals, risk tolerance and values, which includes his focus on healthcare. His confidence towards the platform’s automated process is slowly increasing.

#focused

One final look...

John reviews his answers for the questionnaire one more time and submits. The platform’s AI begins to generate recommendations for John.

I love having few options to select from. Less overwhelming and concise!

I love having options!...

After the AI’s generative process, it provides three portfolio recommendations for John to review and select from. He is excited about this functionality because the limited number of options don’t make him feel overwhelmed.

Let’s see what works best for me...

John reviews all the recommended portfolios in detail, selects a favourable choice and makes adjustments before confirming his investments.

That was so easy!

To always be on top of things, he turns on alerts to receive notifications on changes in the market and forecasts. These are generated by AI through aggregated collection and analysis of news from reliable sources.

From now on, my investments will all be ethical and in support of healthcare

I’m determined to ensure that majority of my investments are ethical.

Moving forward, John has decided to commit to ethical investments in order to support healthcare companies and medical innovation.

Design Mood Board Keywords

Brand Colours

Tiled Layout

Minimal with Breathable Space

Intuitive

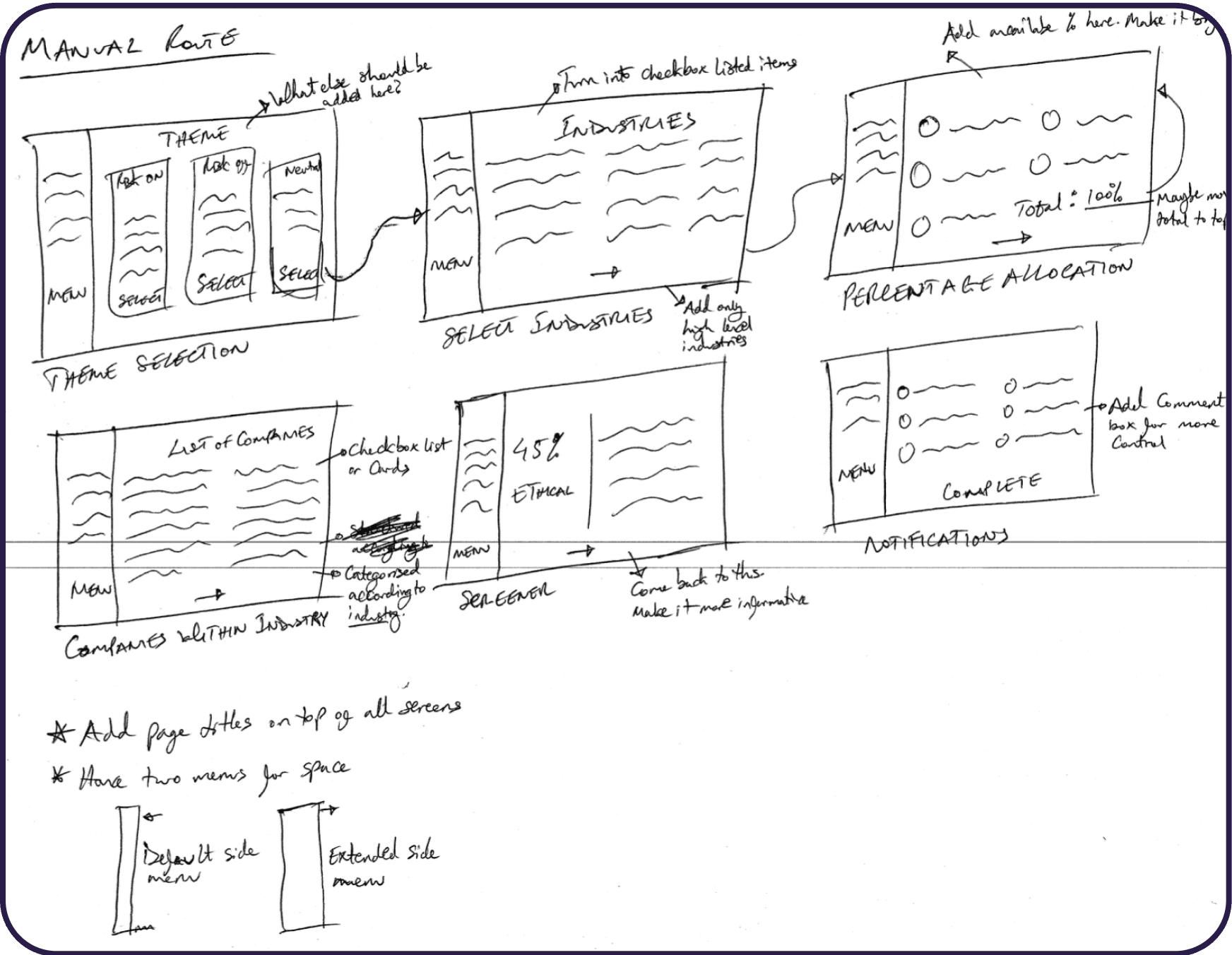

Ideation

Quick and loose sketches with pen on paper to get a rough idea on the overall layout of the platform. These rough interaction flows became the foundation for building the information architecture.

Information Architecture

Quick and loose sketches with pen on paper to get a rough idea on the overall layout of the platform. These rough interaction flows became the foundation for building the information architecture.

User Flow

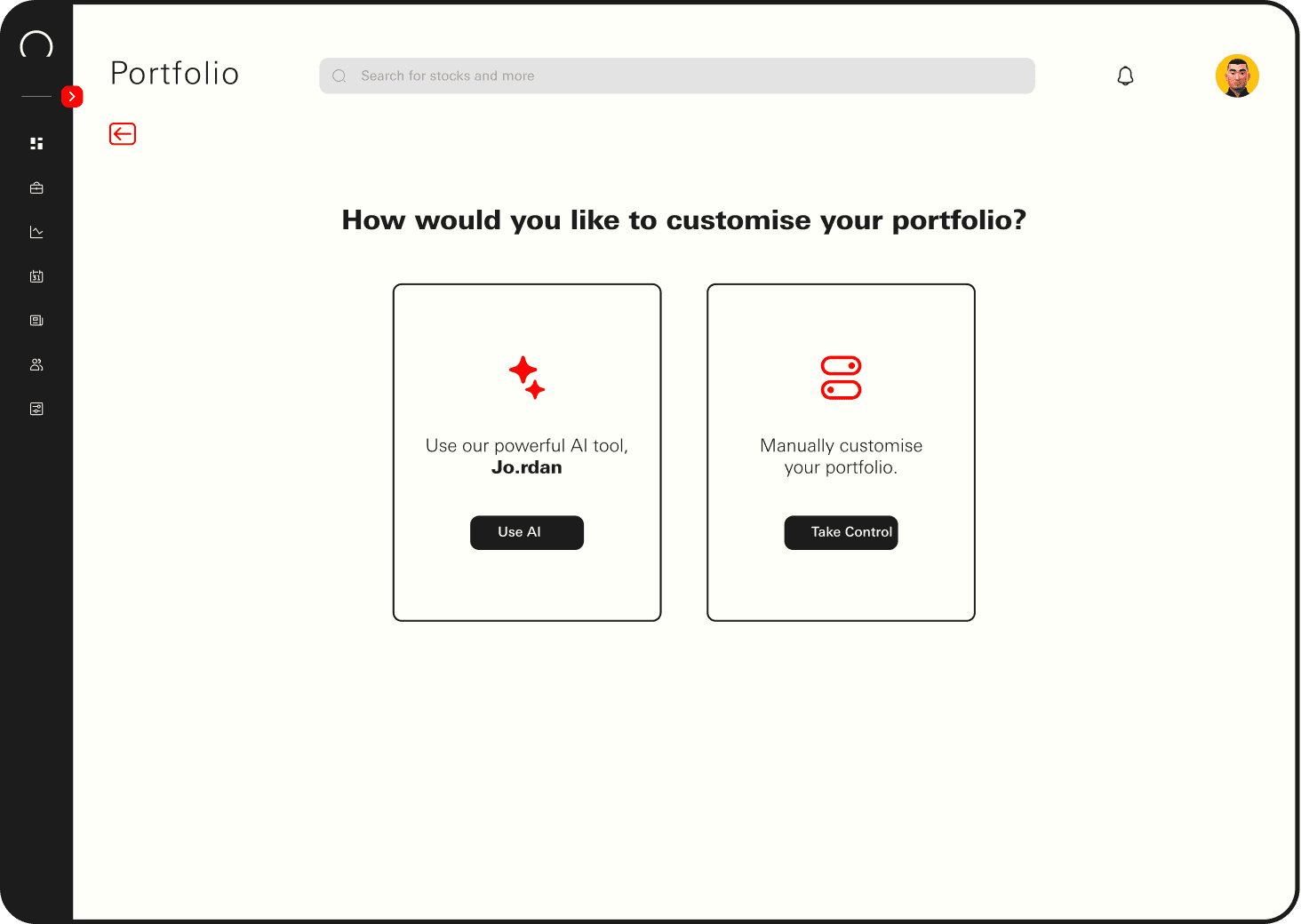

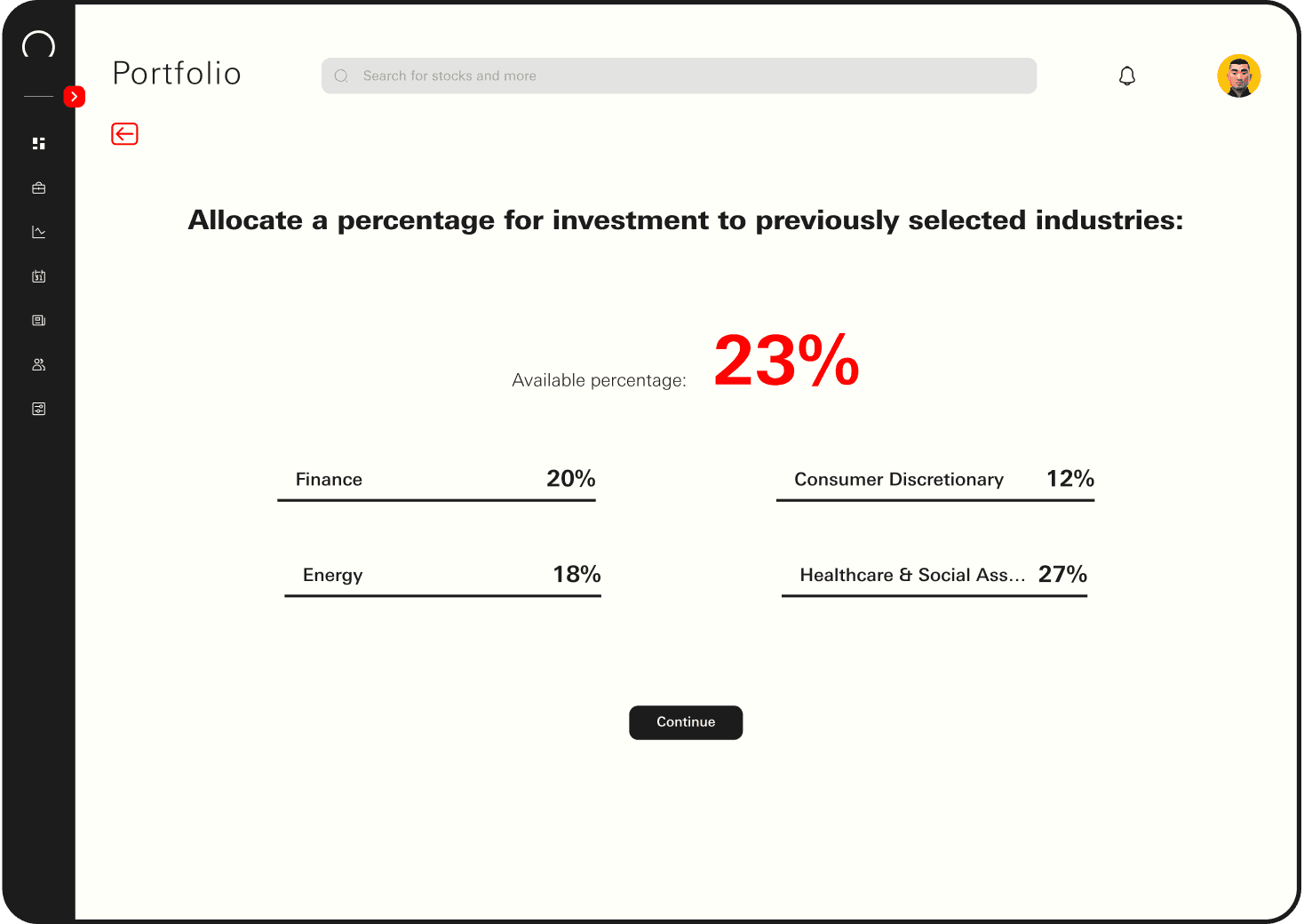

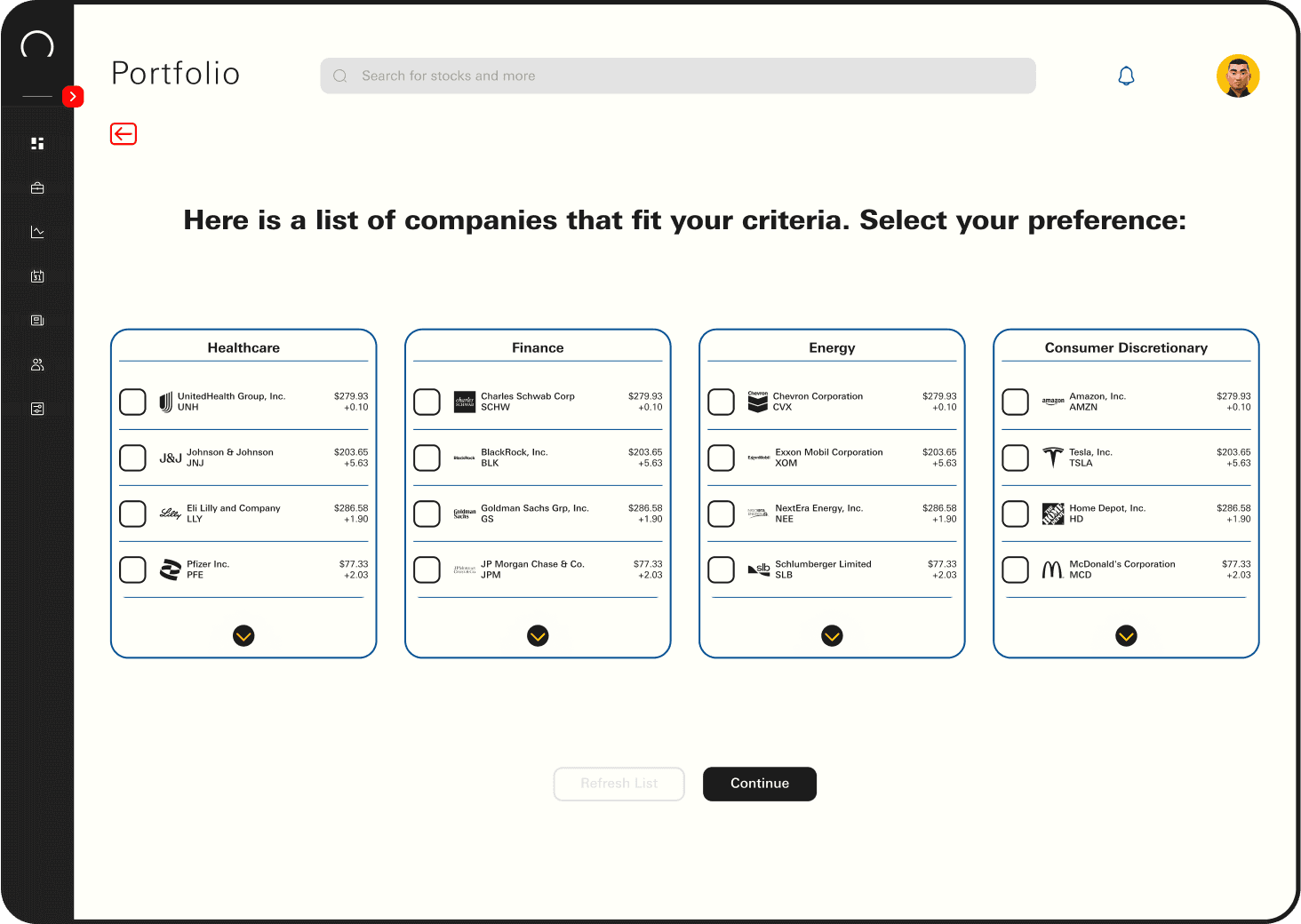

Using the information architecture as a starting point, I developed a diagram showcasing different user paths. The diagram depicts how users could navigate the platform and complete their tasks, whether they chose to use AI or customise their experience manually.

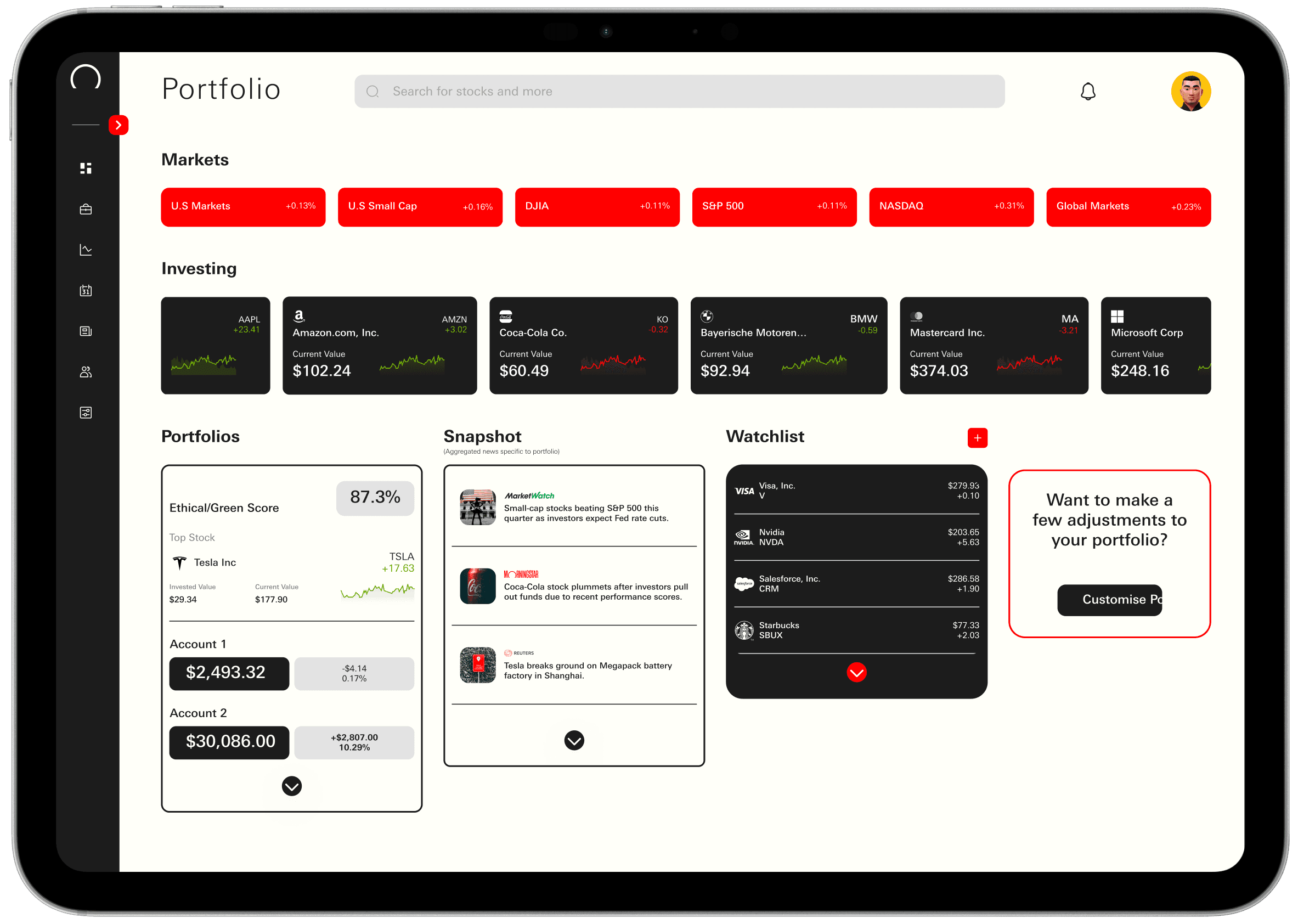

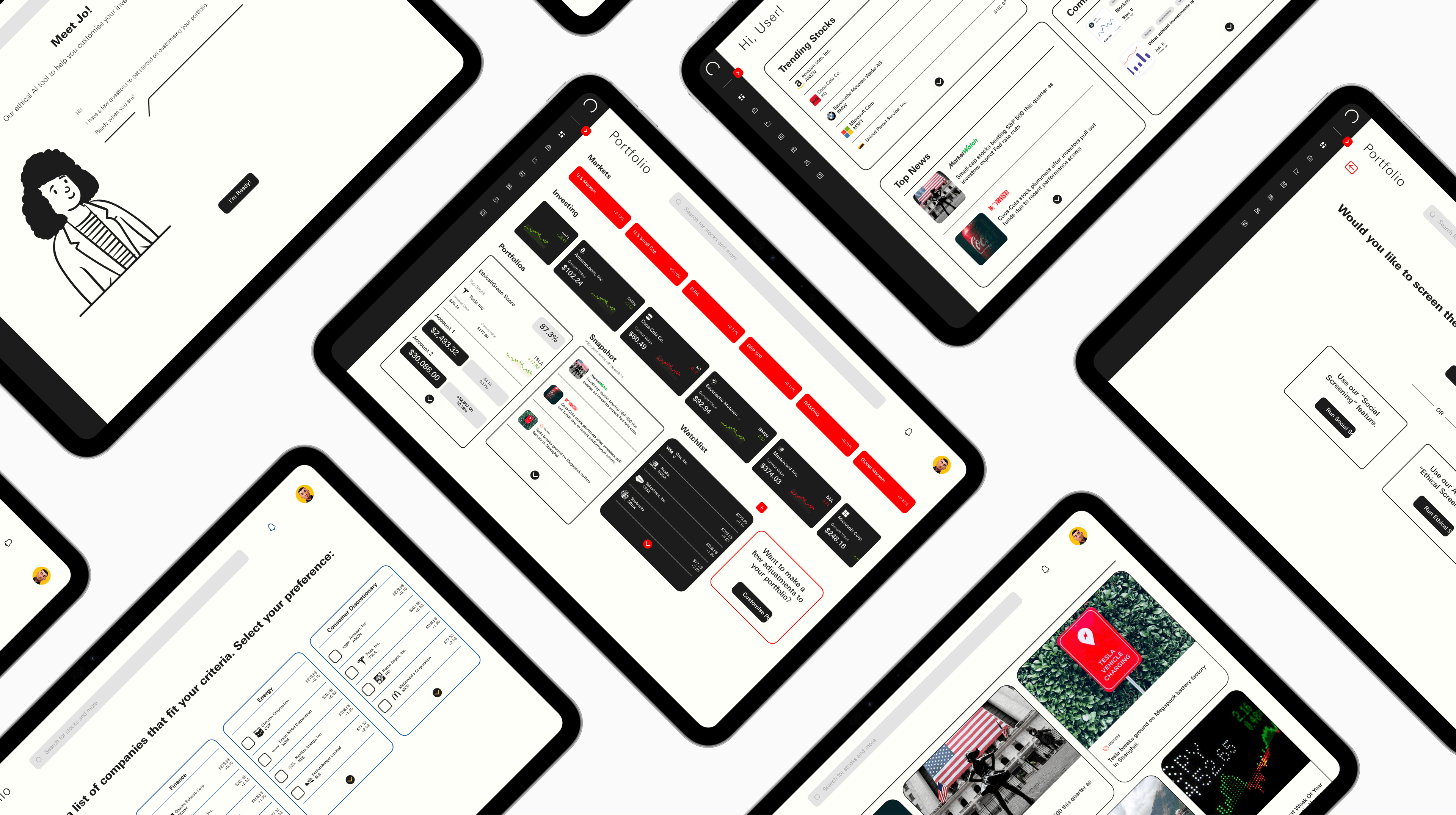

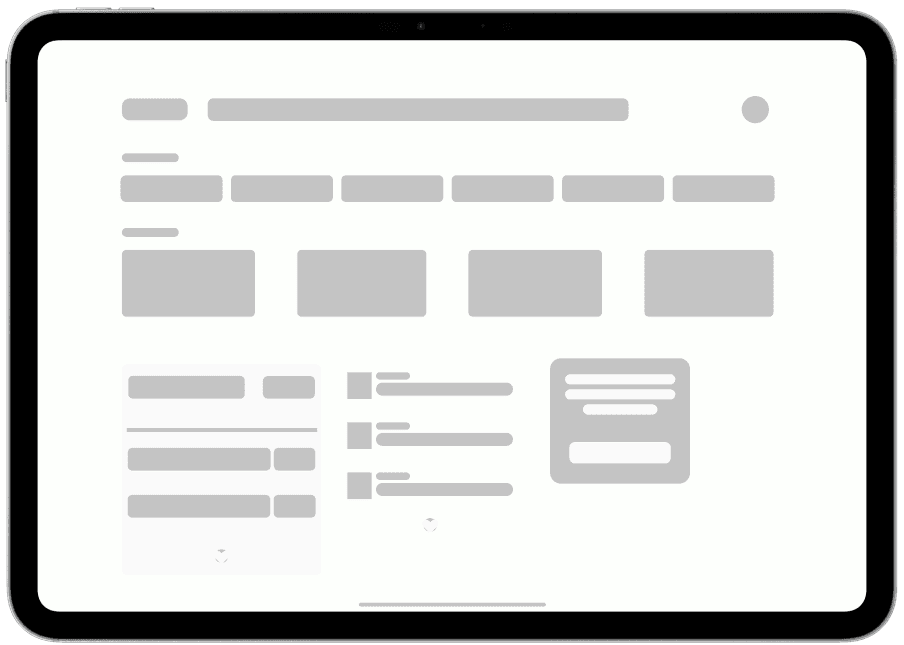

Mid-Fi

Hi-Fi

Design Rationale

The design choices for this prototype prioritised user-friendly navigation, transparency, and personalisation. By organising complex investment information into intuitive categories and offering customisable portfolios, the design enables users to make informed decisions that align with their values.

The system supports both novice and experienced investors through guided tools, clear data presentation, and a scalable structure, ensuring the solution remains flexible as market demands evolve.

These decisions not only enhance the overall user experience, but also align with the Morningstar's goal of fostering ethical investment practices, accommodate individual preferences and improve investor retention.

As newcomers to the financial industry, the team faced challenges in understanding the intricacies of investment analysis, including collecting accurate data due to numerous unknown variables. The engineering team struggled to gather sufficient data for testing the AI model, and while we aimed to provide credible news sources, determining a reliable vetting methodology was difficult. To address this, we opted to use sources trusted by many investors, with plans to improve the vetting process in the future.

Additionally, the dynamic nature of the financial market highlighted the importance of user feedback and real-time data integration, which we were unable to fully implement due to time and resource constraints. Moving forward, we plan to leverage machine learning to identify trends and incorporate tools for risk assessment and management, recognising the need for strong security measures to protect sensitive financial data.

User Experience

Enhanced Decision-Making: By simplifying navigation and providing intuitive categorisation of complex investment data, users will find it easier to make informed decisions that align with their personal ethics and values.

Personalisation and Flexibility: Different portfolio customisation options will give users greater control over their investments, allowing for a more tailored experience that adapts to their individual preferences and goals.

Increased Confidence and Inclusivity: Through clear data presentation, transparency, guided tools, and educational resources, especially on ethical investments, the platform will enhance user confidence and be more inclusive. This approach will ensure that both novice and experienced investors feel supported in their investment decisions.

Business Benefits

Improved Engagement and Retention: By aligning with users' ethical priorities and addressing challenges like accessing and trusting ethical investment data, the platform can stimulate greater engagement. This may eventually lead to increased usage, long-term retention, and overall brand loyalty.

Scalable User Experience: The flexible and scalable design ensures the platform can easily adapt to future market demands or add new ethical investment criteria, supporting long-term business growth without requiring a full redesign. This is achieved through modular architecture of components, intuitive interface and cloud-based AI solutions.

Increased Brand Reputation: By focusing on ethical investing, user-friendly interface, and transparent data, the platform can attract a broader audience, particularly socially conscious investors. This can position the company as a leader in socially responsible investing, strengthening its brand reputation and differentiating it from competitors.